Summer is upon us in Washington, DC. Not only has it been record hot, it has been record busy! Read on to stay informed on these relevant developments for audit committee members.

We welcome input; please let us know what you think. Subscribe here so that you never miss an update from the CAQ.

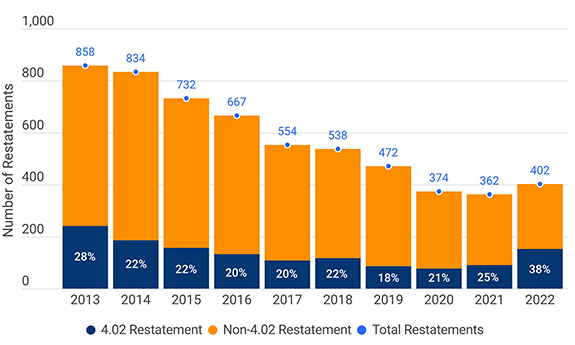

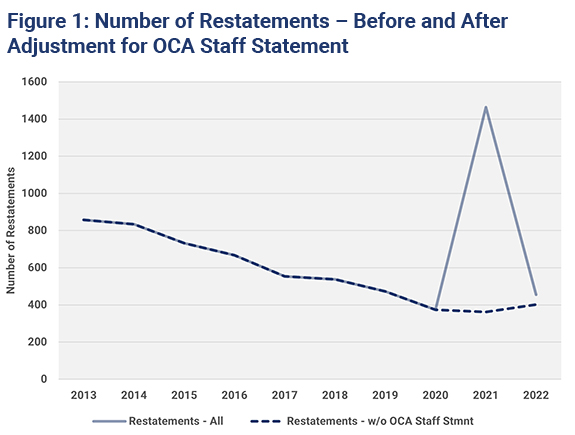

Financial Restatements on the Decline in the United States: 2013-2022

The CAQ conducted an analysis of restatements announced during the period 2013 – 2022. Restatement activity is commonly referenced as a measure of financial reporting quality; therefore, a periodic review of associated trends may be of interest to investors and other users of financial statements.

Additionally, given changes in both the regulatory and economic environments, an analysis of restatement trends provides insight into how the financial reporting ecosystem is managing factors that can affect the risk of material misstatement.

We adjusted for a spike in restatements in 2021 due to special purpose acquisition companies (SPACs); while SPACs are not new to the market, the spike in restatements was primarily due to a narrow issue related to accounting for warranties.

What were our Key Findings?

- Restatements have declined overall with 4.02 restatements (i.e., “Big R” restatements) exhibiting the most consistent decline throughout the sample period.

- Expenses, specifically the misapplication of reporting rules for accruals, reserves, and estimates, are cited most frequently in restatement announcements.

- Fraud is implicated in 3% of the total population of restatements and 7% of 4.02 restatements overall.

- The industries contributing the most to the population of restatements are: 1) Financial, Banks & Insurance, 2) Healthcare & Pharmaceuticals, and 3) Computer & Software.

- Companies that have announced restatements over the sample period are relatively small, in terms of average assets, and are increasingly traded on the NASDAQ.

- Public companies that have announced restatements are more likely to have ineffective internal control over financial reporting (ICFR) based on management’s assessment.

- Ineffective ICFR reports are generally issued after a restatement is announced, i.e., ICFR reports are not predictive of restatements.

- Early evidence suggests CAMs do not provide information about restatement risk.

The takeaway for audit committees? Consider the risk of material misstatement of your company specific to the common drivers of misstatements – accounting for expenses, smaller company with possibly a less mature internal control structure, and potential increase due to industry risk factors.

PCAOB Spotlight: Conversations with Audit Committee Chairs

In June 2024, the PCAOB published its Spotlight: 2023 Conversations with Audit Committee Chairs based on more than 200 conversations with audit committee chairs.

Focus areas in this Spotlight include:

• Current Economic and Audit Workforce Environments

Among the most oft-mentioned economic topics audit committee chairs discussed with their auditors were (1) interest rate fluctuations, (2) inflation, (3) supply-chain challenges, such as delays in or an inability to obtain necessary materials, and (4) the economic impacts of the Russia-Ukraine war.

Several chairs noted that they continue to have concerns about the impact working in remote and hybrid environments will have on the long-term development of professionals. Audit committee chairs stated that this, coupled with the pipeline concerns of attracting new people into the auditing profession, could lead to an insufficient number of qualified auditors.

• Significant Discussions with Auditors

Audit committee chairs spent significant time discussing the following topics with their auditors (other than required communications): Goodwill impairment, interest rates, internal control deficiencies, fraud, liquidity, cybersecurity, and auditor independence.

• Monitoring Quality Control Systems and Independence

Most audit committee chairs said they closely monitor quality control systems and independence through regular conversations with their auditors. These conversations focus on, for example, auditor presentations and the firm’s most recent PCAOB inspection report and include a discussion regarding what the firm is doing to remediate identified deficiencies. PCAOB staff observed, however, that some audit committees did not appear to spend the same amount of time on this review.

Board Oversight of GenAI

KPMG’s recent paper provides directors with a foundational view of GenAI and suggests questions to help management prepare for the challenges and opportunities presented by GenAI.

According to KPMG’s Board Leadership Center Survey, A Boardroom Lens on Generative AI (March 2024), directors are currently most concerned about the reliability of GenAI-supported data/results, cybersecurity, and data privacy. Other risks that are likely to grow as GenAI moves from experimentation to company-wide adoption include compliance, intellectual property, and reputational risks.

KPMG further identifies issues that may require the attention of the audit committee, such as:

- GenAI use in the preparation and audit of financial statements and drafts of SEC and other regulatory filings;

- GenAI use by internal audit and the finance organization, and whether they have the necessary talent and skillsets;

- Development and maintenance of internal controls and disclosure controls and procedures related to GenAI;

- Oversight of compliance with GenAI laws and regulations;

- Cybersecurity and data privacy risks associated with the use of GenAI (as many audit committees already oversee these risks).

ICYMI: CAQ Public Policy Technical Alert (PPTA), April / May 2024

Each month, the PPTA highlights and examines the regulatory, standard-setting, legislative, and broader financial reporting developments impacting the public company audit profession. The CAQ’s April 2024 and May 2024 Alerts included these featured articles.

Fostering a Healthy ‘Tone at the Top’ at Audit Firms

The SEC posted a statement by SEC Chief Accountant Paul Munter, “Fostering a Healthy ‘Tone at the Top’ at Audit Firms.” In the statement, Munter discusses why the tone at the top matters for public accounting firms and emphasizes the importance of firm leaders leading by example and by prioritizing integrity and professionalism over profit and growth.

PCAOB Adopts New Quality Control Standard (QC 1000), Pending SEC Approval

On May 13, 2024, the PCAOB adopted a new quality control (QC) standard. The new standard would require all PCAOB registered firms to identify their specific risks and design a QC system that includes policies and procedures to guard against those risks. Among the key provisions:

- All PCAOB-registered firms would be required to design a QC system that complies with the new standard

- Those firms would be required to annually evaluate their QC system and report the results of their evaluation to the PCAOB on new Form QC

- Firms that audit more than 100 issuers annually would be required to establish an external oversight function for the QC system

Subject to approval by the SEC, the new standard and related amendments will take effect on December 15, 2025. The final standard is open for public comment to the SEC. Send an email to rule-comments@sec.gov. All submissions should refer to PCAOB-2024-02 and should be submitted on or before July 2, 2024.

A New PCAOB Staff Report Shares Observations on How Root Cause Analysis Can Drive Audit Quality

The PCAOB posted a new staff report, Spotlight: Root Cause Analysis – An Effective Practice To Drive Audit Quality. The publication provides an overview of the topic, general considerations regarding root cause analysis, other observations about root cause analysis from PCAOB inspections, and key questions for audit firms to consider.

New IFRS Accounting Standard Will Aid Investor Analysis of Companies’ Financial Performance

The IFRS announced it completed its work to improve the usefulness of information presented and disclosed in financial statements. The new Standard, IFRS 18 Presentation and Disclosure in Financial Statements, will give investors more transparent and comparable information about companies’ financial performance, thereby enabling better investment decisions. It will affect all companies using IFRS Accounting Standards. IFRS 18 introduces three sets of new requirements to improve companies’ reporting of financial performance and give investors a better basis for analyzing and comparing companies:

- Improved comparability in the statement of profit or loss (income statement)

- Enhanced transparency of management-defined performance measures

- More useful grouping of information in the financial statements

IFRS 18 is effective for annual reporting periods beginning on or after January 1, 2027, but companies can apply it earlier. IFRS 18 replaces IAS 1 Presentation of Financial Statements.

10 Fast-Growing Summer Vacation Spots In 2024

Looking for somewhere new and exciting this year (or next)? Check out the most popular international vacation destinations for U.S. travelers this summer, per Tripadvisor’s new summer travel index (according to Forbes).

- Maunabo, Puerto Rico

- Puerto Rico, Spain

- Playa Avellana, Costa Rica

- Cusco, Peru

- Iru-fushi, Maldives

- St. John, U.S. Virgin Islands

- Aguas Calientes, Peru

- Malé, Maldives

- Fasmendhoo, Maldives (3rd listing! We see you Maldives!)

- Andros, Bahamas

Here’s to a great Summer of ’24!

Questions and comments about Audit Committee Insights can be addressed to Vanessa Teitelbaum, Senior Director, Professional Practice (vteitelbaum@thecaq.org).

This newsletter is intended as general information and should not be relied upon as being definitive or all-inclusive. The CAQ encourages readers to refer to applicable rules, standards, guidance, and other resources in their entirety. All entities should carefully evaluate which requirements apply to their respective organizations.