As the end of February approaches, the end of winter is in sight. This may be good news if you are in a cold climate and prefer warmer temperatures. Or perhaps you are a skier who will miss the snow (just kidding…ski season is also busy season; we accountants don’t have time for it). It’s a busy time for audit committees too and you need to keep current on the evolving regulatory environment. Read on to learn about the latest developments.

We welcome input; please let us know what you think. Subscribe here so that you never miss an update from the CAQ.

Cyber, ERM, and Talent Are Top Priorities for Audit Committees

In our fourth edition of the Audit Committee Practices Report, a joint effort between Deloitte’s Center for Board Effectiveness (Deloitte) and the Center for Audit Quality (CAQ), cybersecurity, enterprise risk management (ERM) and finance and internal audit talent top the list of audit committee priorities for 2025. These are priorities beyond oversight of the financial statements and internal control over financial reporting – the two areas audit committees tell us is their core focus.

A total of 237 respondents participated in this year’s survey, primarily on boards of US (89%) public (86%) companies with more than $2 billion in market cap (72%). Directors on boards of financial services companies made up 27% of the respondents.

We also found that a majority of respondents are interested in enhancing the effectiveness of audit committee meetings. When presented with various strategies to achieve this, the two most prominent areas identified were the quality of presentations during meetings and the level of discussion and/or engagement from members.

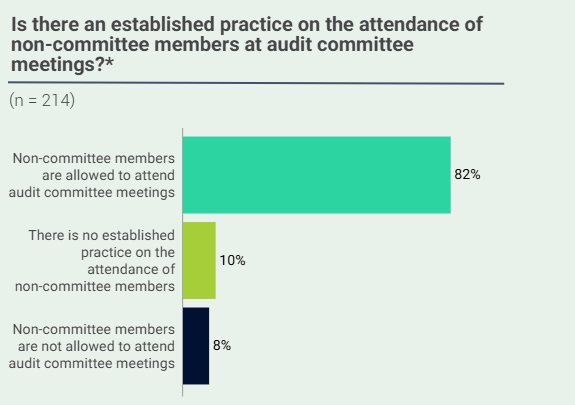

Another topic often raised by audit committees relates to the participation of non-committee members in audit committee meetings. New this year, we asked if there are established practices to allow non-committee member participation. Overall, 82% responded that non-committee members are allowed to attend audit committee meetings, while 8% indicated that non-committee members are not allowed to attend the meetings. Additionally, 10% said there is no established practice around this, suggesting an opportunity to formalize a clear practice around who can attend meetings.

By leveraging the insights and data presented in this report, directors and governance professionals can benchmark their practices, address emerging risks, and enhance the overall effectiveness of their audit committees. We hope this report serves as a valuable resource in navigating the complexities of audit committee responsibilities and fostering robust governance practices.

To learn more about this report, register for our upcoming webinar on April 8, 2025 (1-2 pm ET) featuring Vanessa Teitelbaum, Krista Parsons, Tony Anderson, and Karen Golz.

Safeguarding Crypto Assets: SEC SAB 121 Rescinded

SEC Staff Accounting Bulletin (SAB) 121 has been the subject of controversy since issued in 2022, and effective January 23, 2025, it was rescinded with the issuance of SAB 122.

Deloitte explains that SAB 121 required the fair value of the crypto assets being safeguarded to be recorded as a liability, with a corresponding asset, when an entity does not control the crypto assets.

PwC further elaborates that SAB 122 rescinds this guidance and is effective for annual periods beginning after December 15, 2024. The interpretive guidance is required to be applied retrospectively to all prior periods. Upon adoption, reporting entities should include disclosure of the effects of the change in accounting principle in accordance with ASC 250, Accounting Changes and Error Corrections. Early adoption is also permitted, which means that reporting entities that have not filed (or issued) their financial statements and early adopt SAB 122 would not include the safeguarding liability and corresponding asset (or any of the SAB 121 required disclosures) in their 2024 financial statements. An entity that has a safeguarding obligation should assess whether it has any loss contingencies under ASC 450, Contingencies. SAB 122 does not affect the guidance in ASC 350-60 related to accounting and disclosures for certain crypto assets.

PCAOB Withdraws Firm and Engagement Metrics and Firm Reporting Proposed Rules

On February 11, 2025, the SEC released notice that the PCAOB withdrew the proposed rules on Firm and Engagement Metrics and Firm Reporting. These proposed rules were adopted by the PCAOB on November 22, 2024 with a 4-1 vote.

The CAQ, along with other profession representatives, supported the Board’s objectives but raised concerns related to whether the benefits of the required disclosures would outweigh the costs. We recommended more research and dialogue among stakeholders.

What would the proposed rules require?

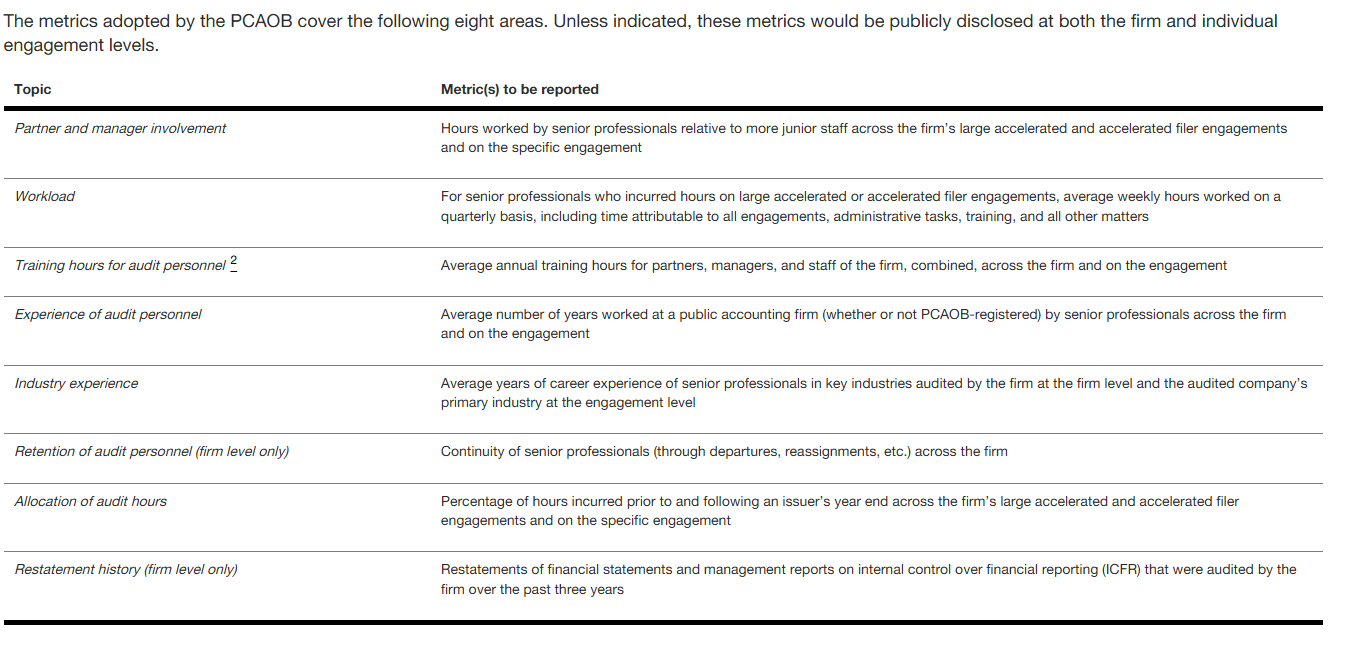

Key elements of the Firm and Engagement Metrics proposed rules:

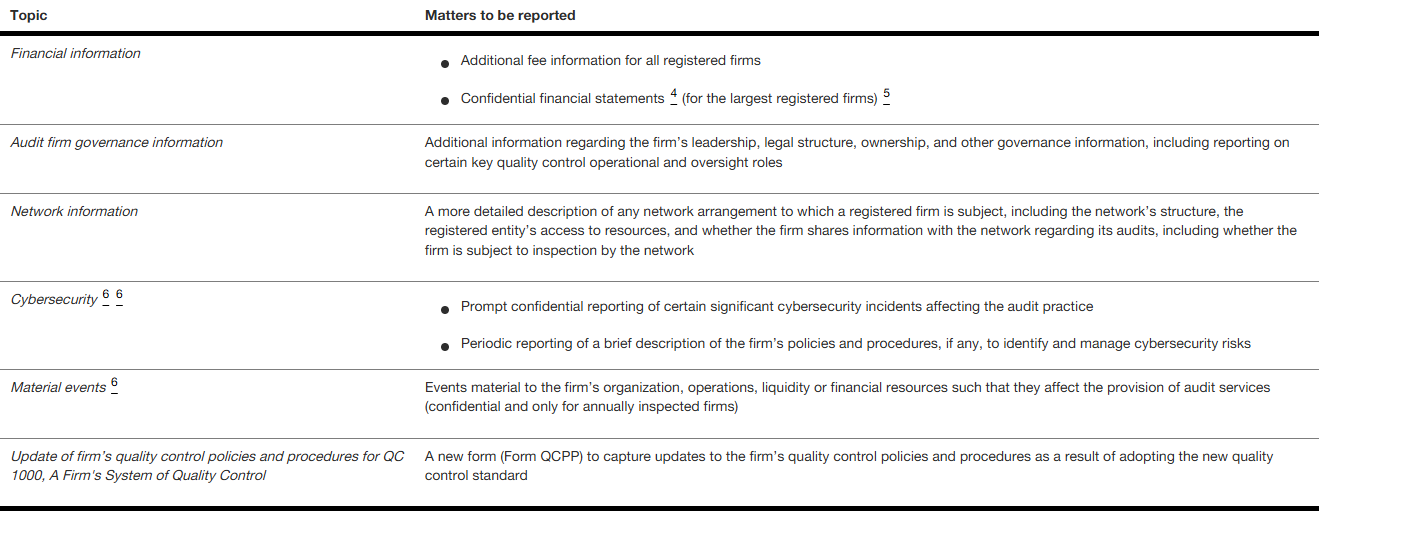

Key elements of the Firm Reporting proposed rules:

Key elements of the Firm Reporting proposed rules:

This important topic of how best to provide information about the audit to stakeholders is sure to continue. We encourage audit committees to engage with the audit partner related to important topics that could impact audit quality such as staff turnover, audit milestones, and staff workload.

What ever happened to the PCAOB NOCLAR Proposal?

The PCAOB’s June 2023 Noncompliance with Laws and Regulations (NOCLAR) Proposal garnered a lot of attention in the form of comment letters, Congressional hearings and a virtual roundtable. The plan to adopt a final rule in 2024 was pushed to 2025 according to the latest standard-setting agenda.

In November 2024, the PCAOB posted a new report, Spotlight: Auditor Responsibilities for Detecting, Evaluating, and Making Communications About Illegal Acts. This staff publication focuses auditors on relevant considerations when performing procedures to detect, evaluate, and make communications about illegal acts by a company under audit under existing PCAOB standards and federal securities laws.

Is the NOCLAR proposal dead? How the final rule will evolve compared with the proposal is subject to speculation. The need to update the 1997 standard still exists and there is a great deal of common ground among stakeholders as to how to do just that. Given the complexity of the topic and the feedback received from stakeholders, it’s not surprising that the Board is taking more time. In other words … stay tuned.

ICYMI: CAQ Public Policy Technical Alert (PPTA), December 2024/January 2025

Each month, the PPTA highlights and examines the regulatory, standard-setting, legislative, and broader financial reporting developments impacting the public company audit profession. The CAQ’s December 2024 and January 2025 Alerts included these featured articles.

FASB Clarifies Interim Effective Date for New Disaggregation of Income Statement Expenses Standard for Non-Calendar Year-End Entities

The FASB published an Accounting Standards Update (ASU) that clarifies for non-calendar year-end entities the interim effective date of Accounting Standards Update No. 2024-03, Income Statement—Reporting Comprehensive Income—Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses. Public business entities are required to adopt the guidance in Update 2024-03 in annual reporting periods beginning after December 15, 2026, and interim periods within annual reporting periods beginning after December 15, 2027. Early adoption of Update 2024-03 is permitted.

Sustainability Reporting and Assurance: Key Considerations for Legislators and Regulators

The CAQ posted a publication on sustainability reporting and assurance that explores important considerations for legislators and regulators as they respond to the evolving needs of the market by contemplating laws and regulations requiring companies to report sustainability information.

ESG Reporting: A Primer on Key Regulatory Reporting Requirements for U.S. Based Entities

The CAQ posted ESG Reporting: A Primer on Key Regulatory Reporting Requirements for U.S. Based Entities. This publication offers insight into:

- Key regulatory ESG reporting requirements and standards likely to impact U.S. entities

- Ongoing developments that should be monitored

- Practical implementation considerations

SNL is 50 and Other Fun Facts from 1975

It’s an impressive feat to last 50 years in show business. If you didn’t stay up late to catch the SNL is 50 Anniversary Special, you can be glad that it’s not 1975 and you can watch the highlights on YouTube.

What else was happening the year that Saturday Night Live premiered? Here are some fun facts from 1975:

- Song of the Year: Captain and Tennille, “Love Will Keep Us Together” (and now this song is stuck in your head…).

- Album of the Year: Paul Simon, “Still Crazy After All These Years.”

- Top movies: “One Flew Over the Cuckoo’s Nest,” “Jaws,” “Monty Python and the Holy Grail.”

- Best Picture Oscar Winner: “The Godfather Part II.”

- “A Chorus Line” appears on Broadway.

- “All in the Family” is America’s top television show for the fifth straight year.

- President: Gerald R. Ford.

- Unemployment: 5.6%.

- Cost of first-class stamp: $.10; Quart of milk: $.46; loaf of bread: $.33.

- Vietnam War ends (April 30).

- Apollo and Soyuz spacecraft take off for U.S.-Soviet link-up in space (July 15).

- Home videotape systems (VCRs) are developed in Japan by Sony (Betamax) and Matsushita (VHS).

- Computer hobbyists Stephen Wozniak and Steven Jobs begin working on computer designs. Together they develop the Apple 1 prototype.

- Super Bowl: Pittsburgh Steelers 16, Minnesota Vikings 6 (What’s old is new again!)

- World Series: Cincinnati Reds 4, Boston Red Sox 3.

- NBA Championship: Golden State Warriors def. Washington Bullets 4-0.

- Arthur Ashe wins Wimbledon and World Court Championships; Billie Jean King wins sixth Wimbledon crown and retires from singles.

Questions and comments about Audit Committee Insights can be addressed to Vanessa Teitelbaum, Senior Director, Professional Practice (vteitelbaum@thecaq.org).

This newsletter is intended as general information and should not be relied upon as being definitive or all-inclusive. The CAQ encourages readers to refer to applicable rules, standards, guidance, and other resources in their entirety. All entities should carefully evaluate which requirements apply to their respective organizations.