Analyzing S&P 500 Companies’ 10-K Disclosures: Climate and AI

Advances in technology and investor demand for climate-related information continue to transform the corporate reporting landscape.

As Senior Director of Professional Practice at the Center for Audit Quality (CAQ), I lead advanced technical and policy-oriented projects to identify, develop, and seek consensus on issues affecting the public company auditing profession. We frequently analyze S&P 500 companies’ disclosures to understand corporate reporting trends and emerging areas of investor interest, and provide recommendations to support all members of the profession in an ever-changing reporting environment.

In our latest analysis of S&P 500 SEC Form 10-Ks, we dive into disclosure trends on climate-related information. Given the proliferation of artificial intelligence (AI) across organizations, for the first time this year, we also reviewed AI disclosures in 10-K filings. Read on for my key takeaways.

We frequently analyze S&P 500 companies’ disclosures to understand corporate reporting trends and emerging areas of investor interest.

Climate Reporting Continues to Increase

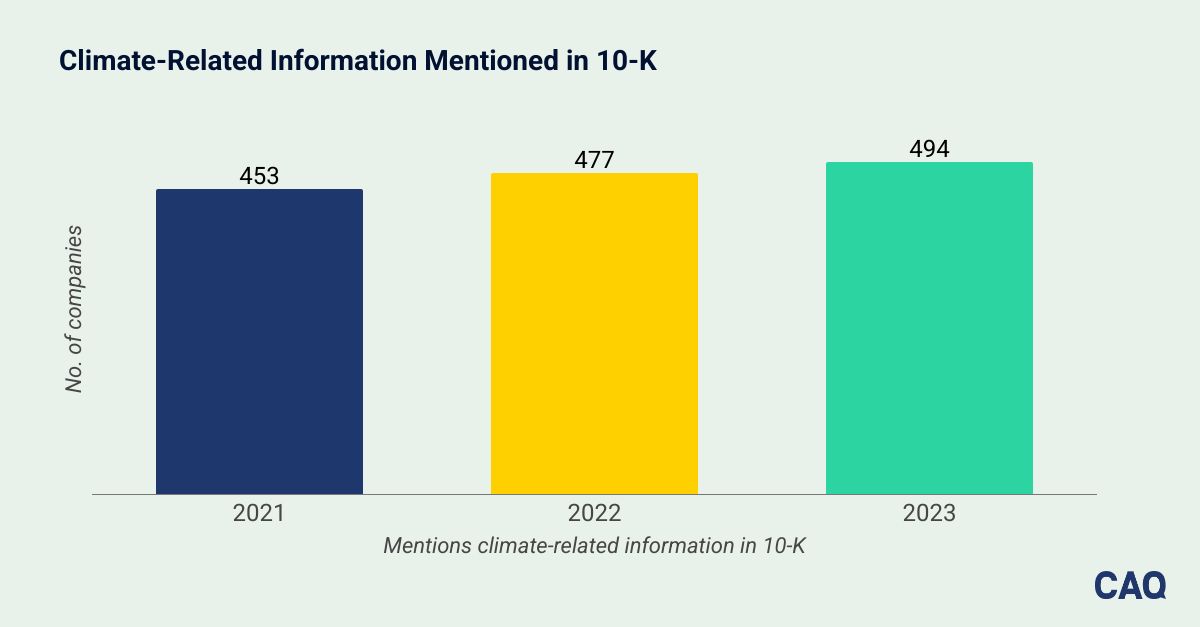

The latest SEC Form 10-Ks (available as of June 30, 2024) demonstrate that organizations are regularly reporting various climate-related information. Our analysis found that most S&P 500 companies mentioned climate-related information in their 10-K, an almost 4% increase from 477 companies in 2022 to 494 companies in 2023.

We found that the types of information included in the climate-related disclosures varied from company to company. Several companies associated dollar amounts with their climate-related information, which included capital expenses, research and development (R&D) costs, losses associated with severe weather events, and more. Some companies disclosed the use or sale of carbon offsets or renewable energy certificates (RECs), often in relation to their discussion around GHG emissions reductions or other related goals.

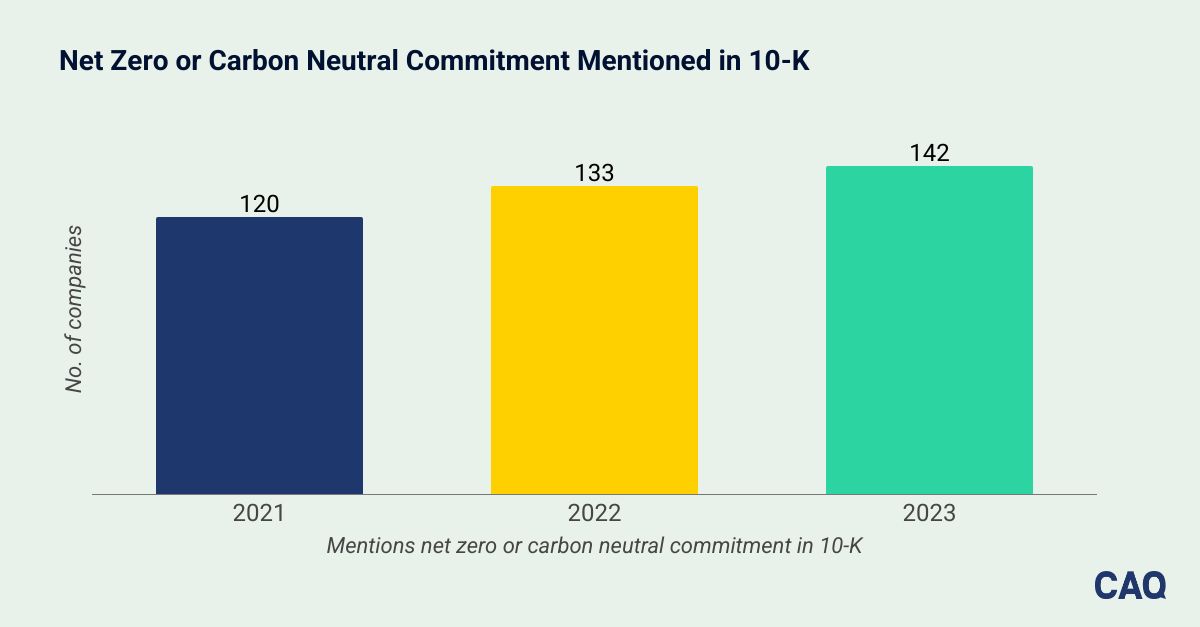

In light of investor demand and the global focus on net zero commitments at the time this data was released, more companies disclosed a net zero or carbon neutral commitment than in years past, with a 7% increase from 2022. While the target dates varied, we observed that the most common target date was 2050 for both net zero and carbon neutral commitments.

Furthermore, climate-related mentions in financial statements nearly doubled from the prior year. While companies increased disclosures across various footnotes, we observed the greatest increase in disclosures related to sustainability-linked debt or borrowing arrangements.

This year, we also reviewed whether companies mentioned any ESG reporting standards and frameworks or any upcoming ESG reporting requirements beyond the 2024 SEC Climate Rule in their 10-Ks. We discovered that roughly 17% of companies mentioned using specific ESG reporting standards or frameworks for their sustainability reporting. Many companies mentioned using more than one standard or framework for their sustainability reporting, with the most common being the TCFD recommendations followed by the SASB standards.

Furthermore, climate-related mentions in the financial statements nearly doubled from the prior year.

The Rise of AI-Related Disclosures

For the first time, we reviewed AI-related disclosures to understand where companies were disclosing this information within their 10-Ks and what they were typically disclosing about AI.

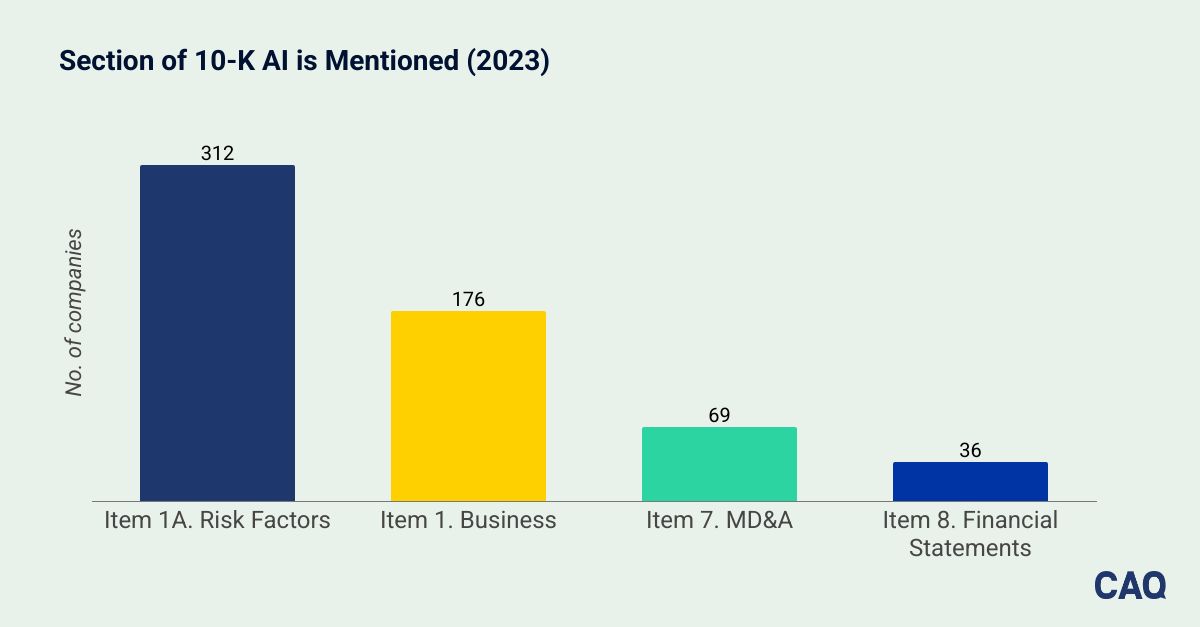

We found that 359 companies, or 72% of S&P 500 companies, mentioned AI-related information in their 10-Ks. Most companies that mentioned AI-related information did so in Item 1A. Risk Factors (312) and Item 1. Business (176). Some companies also mentioned AI within Item 7. MD&A (69) and Item 8. Financial Statements (36).

When discussing AI-related topics in Item 1A. Risk Factors, companies largely focused on legal, regulatory, reputational, and cybersecurity risks. Legal and regulatory risks were noted around companies’ or third parties’ rapid adoption of AI technologies and the privacy or protection of data within these technologies that could be subject to laws, policies, legal obligations, and codes of conduct.

Additionally, companies were concerned that the aggressive use of AI technologies by new entrants to the market may decrease their competitiveness and harm their performance and reputation. Companies noted that the use of data by AI tools increased their exposure to cybersecurity events and flagged that malicious actors could use these technologies to access, use, disclose, or destroy information.

We also observed disclosures that described investments in AI, as companies discussed their use of and investment in AI-related technologies within Item 1. Business.

At the CAQ, we will continue monitoring how companies report this information and how our profession can support high-quality disclosures. Be sure to follow us on LinkedIn for the latest updates.

When discussing AI-related topics in Item 1A. Risk Factors, companies largely focused on legal, regulatory, reputational, and cybersecurity risks.